All Categories

Featured

It seems like the name of this principle changes as soon as a month. You might have heard it referred to as a continuous wide range approach, family financial, or circle of wealth. Regardless of what name it's called, infinite financial is pitched as a secret method to build wealth that just rich individuals understand about.

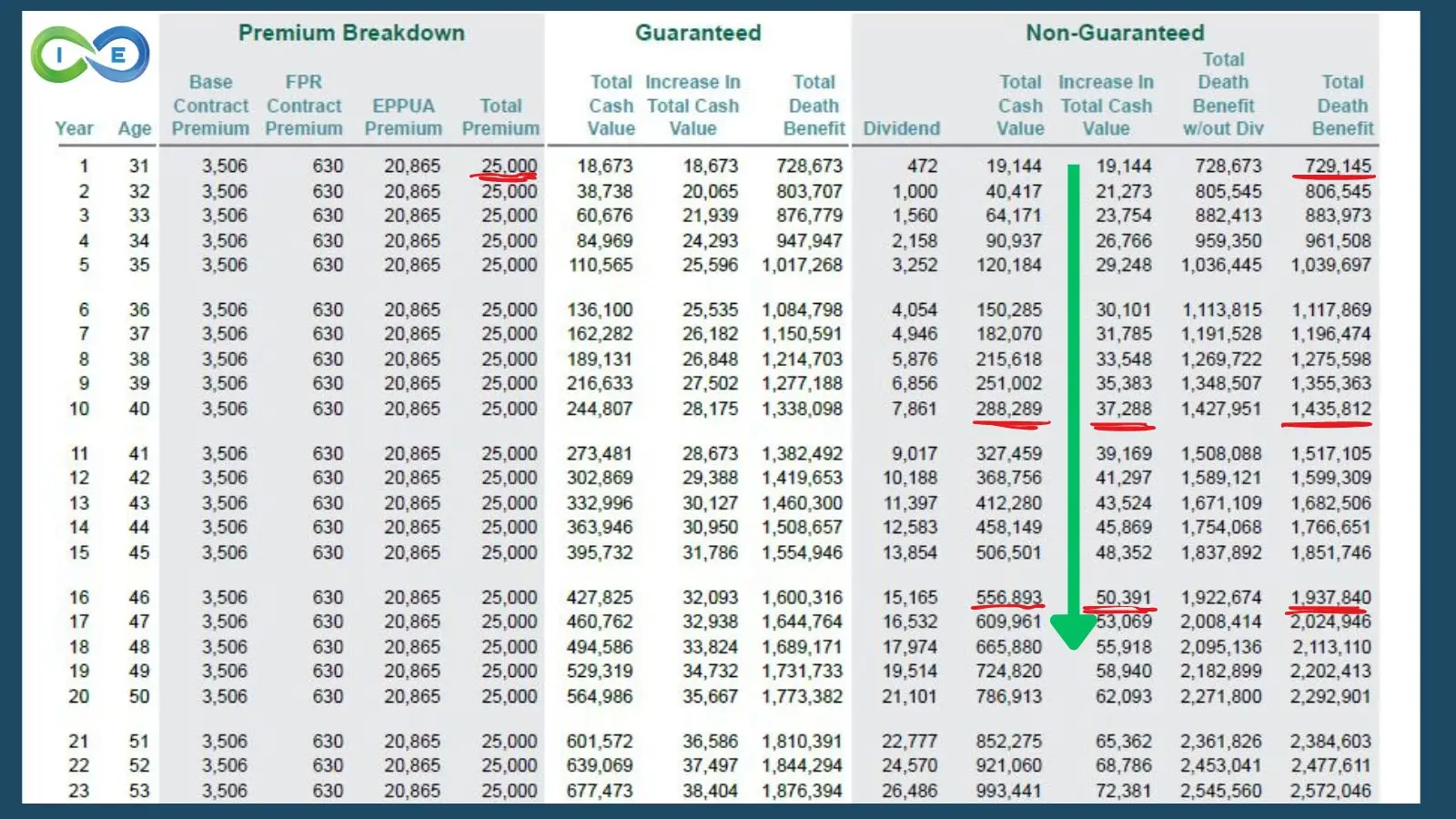

You, the insurance holder, placed cash into a whole life insurance policy plan with paying premiums and buying paid-up additions. This raises the money value of the plan, which suggests there is more cash for the dividend price to be put on, which usually means a higher rate of return in general. Dividend rates at major carriers are currently around 5% to 6% - infinite banking example.

The entire idea of "banking on yourself" only functions due to the fact that you can "bank" on yourself by taking loans from the plan (the arrowhead in the graph above going from whole life insurance coverage back to the policyholder). There are two different kinds of car loans the insurance provider may offer, either straight recognition or non-direct recognition.

Latest Posts

Allan Roth Bank On Yourself

Infinite Banking Concept And Cash Value Life Insurance

Infinite Banking Services Usa